Women In Homeownership

Written By, David Hall

Would you be surprised if I told you that as recently as 1972 a woman wasn’t allowed to purchase a home without a male co-signer, or that lenders only used 50% of a female borrower’s income to qualify them for a loan? Why only half you ask? Lenders were afraid women would get pregnant and would stop working. Some lenders asked for baby letters, a commitment to continue working after giving birth. There was even an instance, according to an article on Realtor.com, of one lender requiring a medical certificate proving sterilization.

Up until landmark legislative changes in the late 60’s and mid 70’s, there was no federal recourse protecting women from lending discrimination based on gender. However, with the passage of the Fair Housing Act (1968) and the Equal Credit Opportunity Act (1974), significant strides were made toward gender equality in housing finance.

Thankfully, the landscape of homeownership changed and by 1981, 11% of home buyers were single women, which was a larger percentage than single men, despite the wage gap that still exists today.

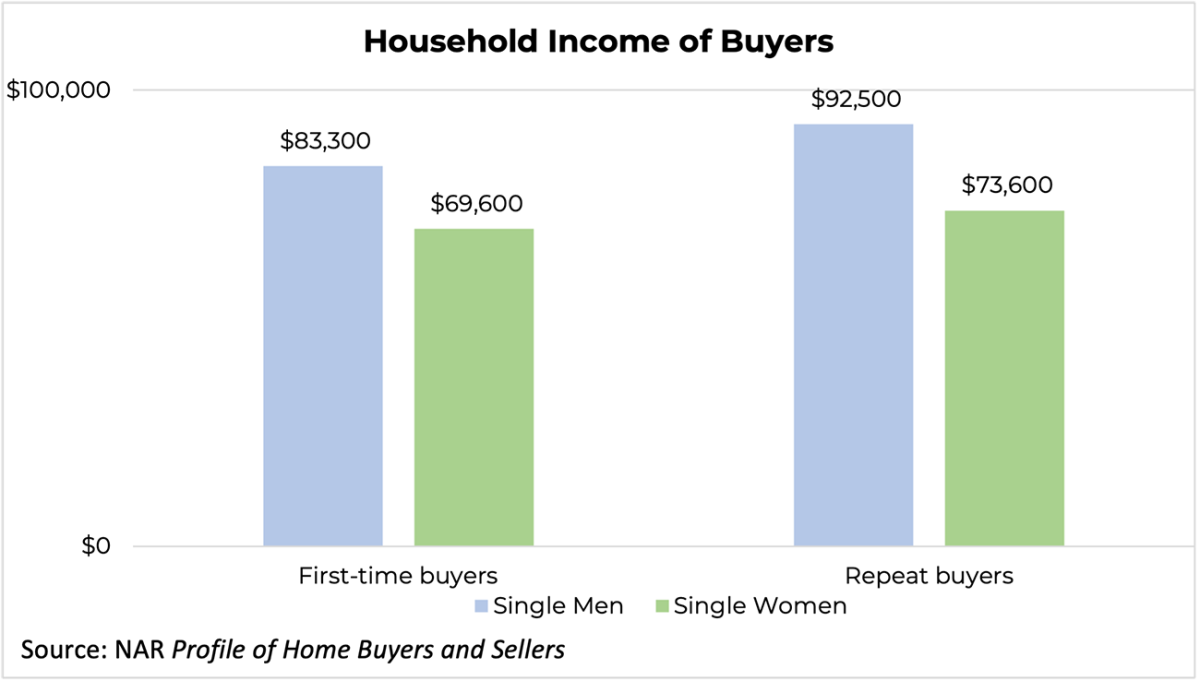

Fast forward to recent years, between 2016 and 2022, the landscape has seen tremendous shifts. Single women from diverse backgrounds are increasingly taking charge of their financial futures and investing in homeownership. Statistics reveal a notable surge, with single women homebuyers comprising between 17-19% of the market, while single men have continued to hover between 7-9%.

This indicative uptick in single women homebuyers highlights a powerful narrative of independence, resilience, and economic empowerment. It reflects not only societal progress, but also the evolving dynamics of homeownership, where women from all walks of life are staking their claim as equal participants.

I have been lucky enough to help several incredibly hardworking and independent, single women throughout my career. I’m also lucky enough to be marrying a woman who purchased her own home when she was single, and I have a sister who bought her home on her own. These women are tremendous examples of what working hard, sacrifice and planning can accomplish and I’m grateful to have them in my life.

As we celebrate these achievements, let’s continue to advocate for inclusivity, affordability, and accessibility in the housing market year round, not just during Women’s History Month. Together, we can work to ensure that every individual, regardless of gender or demographic background, has the opportunity to achieve the dream of homeownership.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link